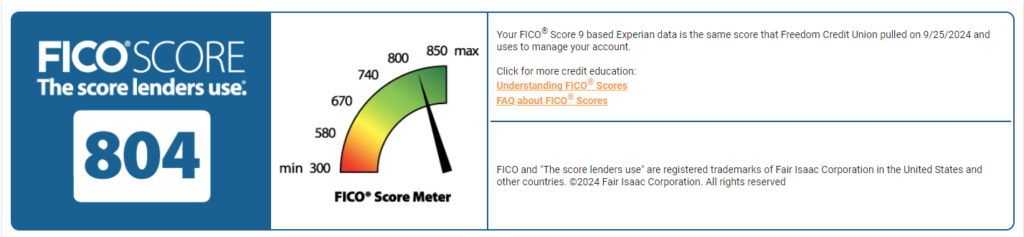

Your updated FICO® Credit Score is now available for viewing! Simply log in to your account and click “My FICO® Score” in the menu to check your latest score. We know that maintaining a strong credit score is important, and we’re here to support you with the tools and information you need.

What is a FICO® Score?

Your FICO® Score is a three-digit number, typically ranging from 300 to 850, that reflects your creditworthiness. Lenders use this score to assess how likely you are to repay loans on time. The higher your score, the more attractive you are to potential lenders, which can help you secure better loan terms and lower interest rates.

Key Factors that Impact Your FICO® Score:

- Payment History (35%)

- Paying your bills on time is the most significant factor. Late or missed payments can negatively impact your score.

- Amounts Owed (30%):

- The amount of debt you owe compared to your available credit is known as your credit utilization ratio. Keeping this ratio low can boost your score.

- Length of Credit History (15%):

- The longer you’ve had credit, the better it is for your score. A long track record of responsible credit use benefits your score.

- New Credit (10%):

- Opening multiple new credit accounts in a short period may lower your score. It’s best to apply for credit only when necessary.

- Credit Mix (10%):

- Having a mix of different types of credit (such as credit cards, auto loans, and mortgages) can positively affect your score.

Tips for Maintaining or Improving Your FICO® Score:

- Pay on Time

- Always make your payments on or before the due date. Setting up automatic payments can help ensure you never miss a due date.

- Keep Credit Balances Low

- Aim to use less than 30% of your available credit limit. Paying off balances in full each month is ideal.

- Limit New Credit Inquiries

- Each time you apply for a new line of credit, a hard inquiry is placed on your credit report. Too many inquiries in a short time can temporarily lower your score.

- Check Your Credit Report Regularly

- Review your credit report annually for errors. Incorrect information can hurt your score, and you can dispute inaccuracies with the credit bureau.

Log in Today to View Your FICO® Score!

If you have any questions or need assistance, feel free to reach out to our member services team.

Not a member of Freedom Credit Union? Join today!